The Huckeby Home Huddle |

April Newsletter |

|

|

|

|

“What Falling Interest Rates Could Mean for You: 7 Key Takeaways for Buyers & Sellers”

With whispers of interest rate cuts on the horizon in 2025, the real estate market could be in for another shift 📊. Whether you're thinking about buying your first home 🧍♂️🔑 or considering listing your property 📦🏠, it's important to understand how changing rates might impact your plans. Here are 7 key points on what this means for both buyers and sellers right now:

If your homeowners insurance goes up and causes your mortgage payment to increase, here are some ways to lower your payment:

1. The Fed May Cut Rates in 2025 🏦

2. Mortgage Rates Are Still Volatile ⚖️

3. Lower Rates Could Reignite Bidding Wars 🔥

4. Refinancing Activity Is Expected to Rise 🔁

5. Affordability Will Slowly Improve 💰

6. Inventory May Tighten Again 📉🏘️

7. Timing the Market Is Still Risky 🎯

Consider a Rate Buy-Down Strategy 🤝As the market adjusts to fluctuating interest rates, both buyers and sellers can explore creative solutions to make deals more attractive. One such strategy is the rate buy-down, where the seller contributes to reducing the buyer’s mortgage rate, potentially making monthly payments more affordable. This can benefit sellers by making their property stand out in a competitive market and appealing to buyers facing higher rates. On the flip side, buyers can use this strategy to lock in a lower rate now, giving them more financial flexibility for the future. If you’re considering buying or selling, let’s talk about how a rate buy-down could work for your situation and help you maximize your opportunities in this evolving market. 📲💬

Example: Comparing Loan Options for a $300,000 Home with and Without a 1-Point Rate Buy-DownLet’s explore how purchasing a 1-point rate buy-down (lowering the interest rate by 1%) could impact monthly payments and how much it might cost for each loan type. A 1-point buy-down typically costs 1% of the loan amount. 1. Conventional Loan (5% Down)

Down Payment: $15,000 (5% of $300,000) Loan Amount: $285,000 Standard Interest Rate: 6.5%

With 1-Point Rate Buy-Down: 5.5%

Savings: $181.59 per month Cost of 1-Point Buy-Down: $2,850 (1% of $285,000) 2. FHA Loan (3.5% Down)

Down Payment: $10,500 (3.5% of $300,000) Loan Amount: $289,500 Standard Interest Rate: 6.25%

With 1-Point Rate Buy-Down: 5.25%

Savings: $180.33 per month Cost of 1-Point Buy-Down: $2,895 (1% of $289,500) 3. VA Loan (0% Down)

Down Payment: $0 Loan Amount: $300,000 Standard Interest Rate: 6.25%

With 1-Point Rate Buy-Down: 5.25%

Savings: $188.33 per month Cost of 1-Point Buy-Down: $3,000 (1% of $300,000) 4. USDA Loan (0% Down, Rural Areas)

Down Payment: $0 Loan Amount: $300,000 Standard Interest Rate: 6.375%

With 1-Point Rate Buy-Down: 5.375%

Savings: $183.47 per month Cost of 1-Point Buy-Down: $3,000 (1% of $300,000) Total Monthly Payments Will Vary

Insurance, Taxes, and PMI: Keep in mind that property taxes, homeowners insurance, and PMI (if applicable) will add to these amounts. Disclaimer:These calculations are for illustrative purposes only and are based on current average rates as of April 2025. The figures assume a 1-point buy-down, which generally costs 1% of the loan amount, but your actual monthly payment and the cost to buy down the rate may vary depending on your lender, credit score, loan type, and other factors. It is important to consult with multiple lenders to get personalized quotes and explore the specifics of a rate buy-down option to best fit your needs.

|

|

|

|

|

|

Landscaping on a Budget! |

|

|

As we welcome the beginning of spring, it's the perfect time to refresh your outdoor space! Landscaping not only creates a peaceful environment to enjoy but can also significantly boost your home's curb appeal—making it a more inviting place for potential buyers. If you're looking to upgrade your landscape on a budget, check out this helpful video from the YouTube channel Project Build Stuff. In it, the creator shares his 5 expert tips for a landscaping makeover that won't break the bank. Whether you're a DIY enthusiast or just looking for a few cost-effective ideas, this video is a must-watch! 🌿🌼

|

|

Courtesy of: Project Build Stuff |

|

|

|

|

Check Out Our New Listings!! |

|

|

|

Like-New 2023 Taber Home – Fully Loaded with Upgrades! 🌟 - $355,000 -This beautiful 4-bedroom, 2-bathroom home offers modern design, energy-efficient features, and premium finishes throughout. Located in a desirable community, this Taber-built home includes a 3-car garage with a storm shelter for added peace of mind. 🚗⚡ 🛋️ Spacious Living Room with cathedral ceilings, crown molding, a cozy gas fireplace, and stylish wood-look tile flooring – perfect for relaxing or entertaining! 🍽️ Gourmet Kitchen featuring stainless steel appliances, 3 CM granite countertops, an oversized island with extended bartop, a farmhouse sink, pendant lighting, and cabinets that reach the ceiling. Plus, a walk-in corner pantry for plenty of storage. 🍳 🛏️ Owner's Suite with a sloped ceiling, ceiling fan, and a luxurious en-suite bathroom with a double vanity, Jetta Whirlpool tub, walk-in shower with floor-to-ceiling tile, and a spacious walk-in closet – conveniently connected to the laundry room for ultimate convenience! 🚿 Secondary Bathroom includes extra built-in storage shelves for easy organization. 💡 Built with Healthy Home Technology, a tankless water heater, whole-home air purification, R44 insulation, and guttering, ensuring comfort and energy efficiency all year round. 🌱 This move-in-ready home is packed with top-of-the-line upgrades and designed for efficiency and comfort! 🏡 |

|

|

|

|

|

|

|

Stunning 5-Bedroom, 3-Bathroom Home on 1 Acre in Guthrie! 🌳 -$350,000-Don’t miss out on this beautiful 5-bedroom, 3-bathroom home nestled on 1 acre in the scenic hills of Guthrie! Perfect for big families and multigenerational living, this home features a second primary suite that can also be used as a game room or movie room—giving you the ultimate flexibility! 🏡✨ 🛏️ Generously sized secondary bedrooms with elegant trayed ceilings, offering a spacious and stylish layout for all your needs. 🔥 Step inside to a warm and inviting living area with wood-look tile flooring, a gorgeous brick fireplace, and soaring 10-foot ceilings—creating the perfect space for entertaining or unwinding. 🍳 The kitchen showcases granite countertops, a large island with bar seating for four, and plenty of room for family meals and gatherings. 🌿 Step outside to your covered back patio—the perfect spot to relax in privacy. Enjoy the fully fenced yard, sprinkler system, and back gate leading to a peaceful creekside. 🌊 💧 Enjoy the added comfort of a salt-based water softener, providing better water quality throughout the home. 🌅 When you pull into the neighborhood, you'll be welcomed by breathtaking hilltop views that make this home truly special. 🚗 Easy access to I-35 & Highway 33, making your commute to Edmond, OKC, or beyond a breeze. This home is perfect if you're looking for space between neighbors, room for a growing family, or a multigenerational home with a private retreat for everyone! 📲 Schedule your showing today before it’s gone! |

|

|

|

|

|

|

|

|

|

5 Tips for Homebuyers in a Busy Market 🏡📈

1. Get Pre-Approved Before You Start 🔑In a competitive market, sellers want to know you’re financially ready. Getting pre-approved for a mortgage will give you a leg up and show you’re serious. It also helps you understand your budget, so you’re not wasting time on homes that may be out of reach. 2. Move Quickly ⚡Homes can go off the market fast, so when you find a property you like, don’t hesitate to make an offer. If you're too slow, you risk losing it to another buyer. Having your pre-approval and necessary documents ready can help speed up the process. 3. Consider a Personal Letter 💌A personal letter to the seller can make your offer stand out, especially in a bidding war. Share your story and why you love the home—it might make an emotional connection that helps your offer rise to the top. 4. Be Ready to Compromise 🤝In a hot market, you might not get everything on your wish list. Prioritize your must-haves and be willing to compromise on other aspects, like cosmetic updates or location, to secure a deal faster. 5. Work with a Local Agent 🏘️A knowledgeable local agent can be a huge asset. They’ll know the market inside and out, helping you move quickly when you find the right home. They may also have insider knowledge about properties before they even hit the market, giving you a competitive edge. |

|

|

|

|

|

|

Trends |

Yukon, OK:

Median Sale Price: $277,123 in March 2025, a 0.9% increase from March 2024. Median Days on Market: 41 days in February 2025, down from 46 days in February 2024. Sale-to-List Price Ratio: 98.0% in February 2025, indicating homes sold for approximately 2% below the asking price on average. Tuttle, OK:

Median Sale Price: $366,767 median list price as of February 28, 2025. Median Days on Market: 42 days in March 2025, a 43.4% decrease from 75 days in March 2024. Sale-to-List Price Ratio: 62% of homes sold below asking price in March 2025, suggesting buyers often negotiated prices down. Edmond, OK:

Median Sale Price: $325,840 in March 2025. Median Days on Market: 57 days in March 2025, down from 81 days in March 2024. Sale-to-List Price Ratio: Homes generally sold close to their list prices, though specific percentages were not provided. Northwest Oklahoma City (NW OKC), OK:

Median Sale Price: $279,000 in February 2025, a 3.3% year-over-year increase. Median Days on Market: 72 days in February 2025, up from 54 days the previous year. Sale-to-List Price Ratio: Homes sold for approximately 1% below list price on average. Mustang, OK:

Median Sale Price: $257,000 in January 2025, a 12.7% year-over-year increase. Median Days on Market: 60 days in January 2025, slightly up from 53 days the previous year. Sale-to-List Price Ratio: 97.1% in January 2025, suggesting homes sold for about 2.9% below the asking price on average. Market Summary:

Yukon: Median sale price of $277,123, with homes selling in approximately 41 days and achieving 98% of the list price. Tuttle: Median list price of $366,767, with homes selling in about 42 days and 62% selling below asking price. Edmond: Median sale price of $325,840, with homes selling in approximately 57 days. NW OKC: Median sale price of $279,000, with homes selling in about 72 days and achieving 99% of the list price. Mustang: Median sale price of $257,000, with homes selling in approximately 60 days and achieving 97.1% of the list price. |

|

|

|

|

|

5 Tips for Home Sellers in a Busy Market 🏡💸

1. Price Your Home Strategically 💰In a fast-moving market, setting the right price is crucial. While you might be tempted to list higher, pricing competitively can attract more potential buyers and even lead to bidding wars. Your agent can help determine the sweet spot for your listing price. 2. Enhance Curb Appeal 🌳First impressions matter! Invest in a few simple updates to your home's exterior, like fresh landscaping or a freshly painted front door. Curb appeal can draw buyers in and make them excited to see more, helping your home sell faster. 3. Stage Your Home 🛋️Staging helps buyers visualize themselves in the space. Consider professional staging or simply decluttering and depersonalizing your home. Clean, well-organized spaces allow buyers to focus on the potential of the property. 4. Be Flexible with Showings ⏰The more available your home is for showings, the better chance you'll have at attracting a buyer. In a busy market, some buyers may only have limited times available to tour homes. Be flexible with showing times, including evenings or weekends, to accommodate more potential buyers. 5. Review Offers Carefully and Be Ready to Negotiate 📝Even in a hot market, you’ll want to review offers carefully. While a higher offer might be tempting, consider contingencies, closing dates, and the strength of the buyer’s financing. A strong offer with fewer contingencies might be a better deal in the long run. |

|

|

|

|

|

|

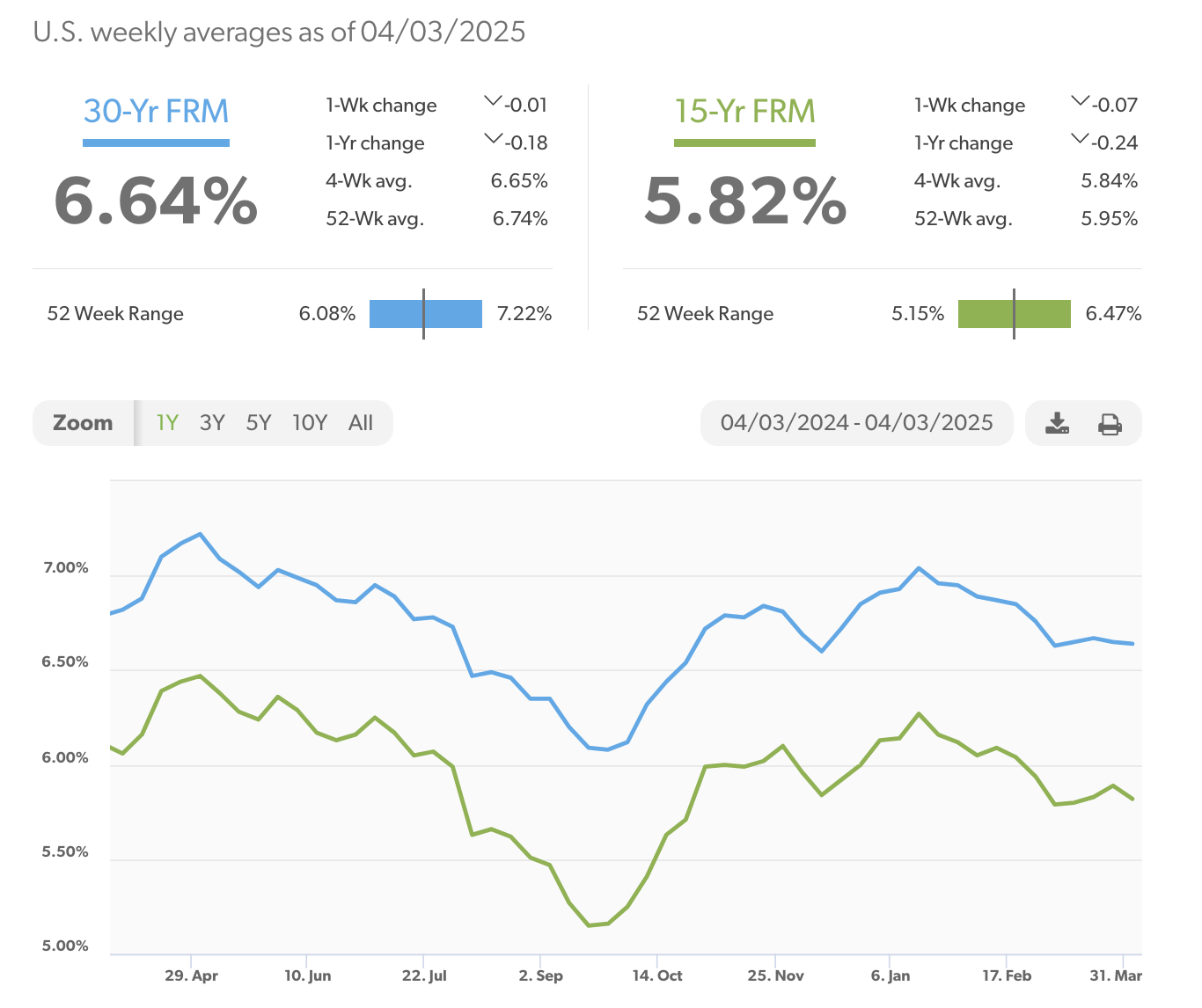

Interest Rates |

As of April 3, 2025, mortgage rates have experienced a slight decline compared to the previous month, offering potential homebuyers modest relief. The average rate for a 30-year fixed mortgage is 6.64%, down from 6.82% at the end of March. Similarly, the average rate for a 15-year fixed mortgage has decreased to 5.82% from 5.89% during the same period. AP News This trend aligns with a broader pattern observed since mid-January, when 30-year mortgage rates peaked above 7%. The recent decrease is largely attributed to falling Treasury yields, influenced by economic uncertainties stemming from new global tariffs imposed by the Trump administration. These tariffs have led investors to seek safer assets like the 10-year Treasury note, thereby reducing its yield and, consequently, mortgage rates. AP NewsMarketWatch+4Barron's+4Latest news & breaking headlines+4MarketWatch However, it's important to note that while lower mortgage rates can enhance affordability, elevated home prices have led to a record-high typical monthly payment of $2,802. This combination presents both opportunities and challenges for prospective homebuyers navigating the current market. AP News Looking ahead, forecasts suggest that mortgage rates will continue to decline throughout 2025, potentially remaining in the mid-6% range for much of the year. This projection offers a cautiously optimistic outlook for buyers, though it's essential to stay informed and consult with financial advisors to understand how these trends may impact individual circumstances. |

|

|

|

|

|

|

|

Age: 8 years, 4 months Weight: 24kg / 53lbs Adoption Fees: $ 75.00 Olaf is a 8 years, 4 months old male Large Mixed Breed who weighs 53 pounds.

Olaf is a really sweet boy who loves attention and adventures. If his person is sitting down, you can usually find him in their lap doing his impression of a cuddle bug! He gets along very well with the dogs in his foster home and, after a slow introduction, Olaf can do well with other dogs of any size. He would do best in a home without feline friends, but he has done well with children who are comfortable with his bouncy play style! He is always down for a walk or some backyard zoomies, as long as you promise him naptime cuddles afterward! Olaf has springs for feet, making him a great jumper. This also means he will need a home with a tall fence to keep him from curiously hopping away. If you are ready to add walking love to your family, come meet your new best friend Olaf!

-Oklahoma Humane Society |

|

|

|

- OKC Broadway's Some Like it Hot, Civic Center Music Hall: April 1-6

- Mother Road, Lyric Theatre: April 2-19

- Tom Segura, Paycom Center: April 4

- Tyler Childers, Paycom Center: April 7

- Kevin Hart, Paycom Center: April 10

- LIVE! on the Pawza, Plaza District: April 11

- Art in Bloom, OKC Museum of Art: April 11-13

- Gabriel Iglesias, Paycom Center: April 12

- Festival of Trains, OKC Fairgrounds: April 12-13

- Midtown Walkabout, Midtown District, April 12

- Earth Fest, Scissortail Park: April 19

- 2025 Better Barrels World Finals, State Fair Park: April 21-27

- OKC Broadway's & Juliet, Civic Center Music Hall: April 29 - May 5

-Visitokc.com |

|

|

|

|

You're at Home with the Huckebys |

|

|

|

|